La lettera di Hill e Vestager al governo italiano

di neXtQuotidiano

Pubblicato il 2015-12-23

Reuters ha pubblicato sul suo sito la lettera della UE al governo italiano Ecco la lettera del 19 novembre dei commissari Ue Hill e Vestager al ministro Padoan sul salvataggio delle 4 banche pic.twitter.com/jjLcMNyhWK — Reuters Italia (@reuters_italia) 23 Dicembre 2015 “We are writing to clarify the Commission’s position concerning the use of deposit guarantee …

Leggi tutto “La lettera di Hill e Vestager al governo italiano”

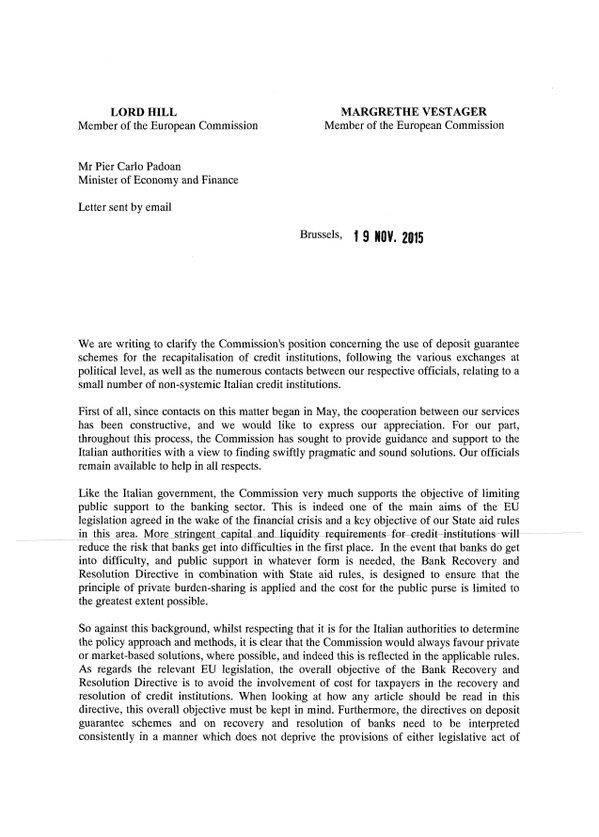

Reuters ha pubblicato sul suo sito la lettera della UE al governo italiano

Ecco la lettera del 19 novembre dei commissari Ue Hill e Vestager al ministro Padoan sul salvataggio delle 4 banche pic.twitter.com/jjLcMNyhWK

— Reuters Italia (@reuters_italia) 23 Dicembre 2015

“We are writing to clarify the Commission’s position concerning the use of deposit guarantee schemes for the recapitalisation of credit institutions, following the various exchanges at political level, as well as the numerous contacts between our respective officials, relating to a small number of non-systemic Italian credit institutions.

First of all, since contacts on this matter began in May, the cooperation between our services has been constructive, and we would like to express our appreciation. For our part, throughout this process, the Commission has sought to provide guidance and support to the Italian authorities with a view to finding swiftly pragmatic and sound solutions. Our officials remain available to help in all respects.

Like the Italian government, the Commission very much supports the objective of limiting public support to the banking sector. This is indeed one of the main aims of the EU legislation agreed in the wake of the financial crisis and a key objective of our State aid rules in this area. More stringent capital and liquidity requirements for credit institutions will reduce the risk that banks get into difficulties in the first place. In the event that banks do get into difficulty, and public support in whatever form is needed, the Bank Recovery and Resolution Directive in combination with State aid rules, is designed to ensure that the principle of private burden-sharing is applied and the cost for the public purse is limited to the greatest extent possible.

So against this background, whilst respecting that it is for the Italian authorities to determine the policy approach and methods, it is clear that the Commission would always favour private or market-based solutions, where possible, and indeed this is reflected in the applicable rules.

As regards the relevant EU legislation, the overall objective of the Bank Recovery and Resolution Directive is to avoid the involvement of cost for taxpayers in the recovery and resolution of credit institutions. When looking at how any article should be read in this directive, this overall objective must be kept in mind. Furthermore, the directives on deposit guarantee schemes and on recovery and resolution of banks need to be interpreted consistently in a manner which does not deprive the provisions of either legislative act of their “effet utile”. On this basis, we find that there is no contradiction between the Bank Recovery and Resolution Directive and the Deposit Guarantee Schemes Directive.

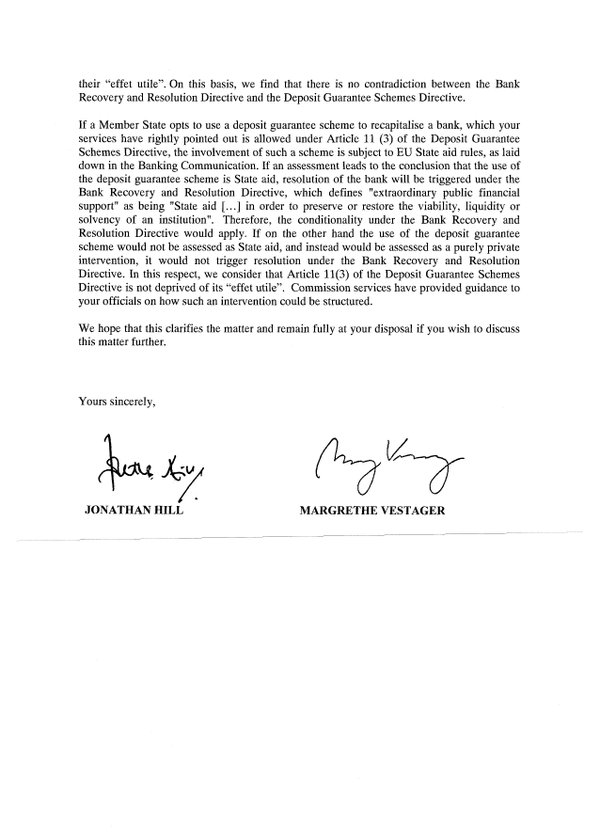

If a Member State opts to use a deposit guarantee scheme to recapitalise a bank, which your services have rightly pointed out is allowed under Article 11 (3) of the Deposit Guarantee Schemes Directive, the involvement of such a scheme is subject to EU State aid rules, as laid down in the Banking Communication. If an assessment leads to the conclusion that the use of the deposit guarantee scheme is State aid, resolution of the bank will be triggered under the Bank Recovery and Resolution Directive, which defines “extraordinary public financial support” as being “State aid […] in order to preserve or restore the viability, liquidity or solvency of an institution”. Therefore, the conditionality under the Bank Recovery and Resolution Directive would apply. If on the other hand the use of the deposit guarantee scheme would not be assessed as State aid, and instead would be assessed as a purely private intervention, it would not trigger resolution under the Bank Recovery and Resolution Directive. In this respect, we consider that Article 11(3) of the Deposit Guarantee Schemes Directive is not deprived of its “effet utile”. Commission services have provided guidance to your officials on how such an intervention could be structured.

We hope that this clarifies the matter and remain fully at your disposal if you wish to discuss this matter further”.